bahamas

Bogdan Dyiakonovych/Shutterstock.com

Country: The Bahamas

Capital City: Nassau

Area: 5,358 sq mi

Population: 389,4821

Life Expectancy: 76 years (women), 72 years (men)

Currency: Bahamas dollar (B$)

Major Language: English

Nassau, SEPTEMBER 27, 2022 (MIC) -

Tourism numbers are nearing pre-pandemic levels

COVID-19 and Economic Wellness

The Bahamas was already reeling from years of stagnant economic growth and increased debt while struggling to recover from devastating storms like Hurricane Dorian in 2019 when the COVID-19 pandemic further aggravated the country’s worsening economic condition.

With annual fiscal deficits already about US$500m since the global financial crisis in 2008, the government felt pressured to abandon the fiscal consolidation strategies that defined public discourse about the state of the economy, since the recession, and instead dramatically boosted spending and, resultingly, the national debt.

The pandemic brought the economy of one of the region’s most tourism-reliant countries to a halt, forcing thousands into unemployment while exposing inadequate public health systems and threadbare social safety net.

At the Abaco Business Outlook conference, Minister of Economic Affairs Michael Halkitis said the pandemic “ripped the covers off, and exposed, the problems that have been plaguing our economy for decades.” He underscored the fact that the country’s gross domestic product had seen barely witnessed than 1% growth in the past 30 years.

At the end of August, the country’s COVID-19 cases were trending downward, with officials hinting that further relaxation of pandemic restrictions like mask-wearing and testing requirements were on the way even as vaccination uptake plateaued.

“I wouldn't say that we’re well on our way,” said economist Hubert Edwards in an interview with MIC.

“I think we are on our way. There are some important and very crucial decisions to be made. As you mention, the NIB (National Insurance Board) circumstance is one of those things. We have decisions to be made, significant decisions to be made around our debt portfolio and the extent to which the government is going to secure additional funding.”

He said: “Right now we are in a position where it is questionable as to the extent to which we can actually meet our expenditure obligations. And if that isn't possible, the extent to which we will have to, we will see austere measure … there'll be some cutting of expenditure and therefore the value or the quality of government services will certainly taper off.”

Edwards added: “I wouldn't say that we are without challenges, but certainly we are at a better place than we were, you know, 12 months ago, 24 months ago. Certainly, coming out of the pandemic, things are moving from an economic perspective, from a pure economic perspective, things are moving in a better direction.”

On the face of it, the country appears to be experiencing an economic rebound, with tourism numbers nearing pre-pandemic levels and tertiary industries like construction and fishing performing in overdrive to make good on lost time.

Tourists are flooding the main airport; the unemployment rate is declining, and a sense of normalcy is returning. However, some fear that the extent of borrowing pursued to survive the nearly three-year paralysis, that the global shutdown placed on the country’s primary economic engine, will force the current Philip Davis-led administration to make some hard decisions.

The tourists are returning.

Edwards said: “The pandemic necessitated us making some decisions and prioritising in some issues. And so, as a result of that we would have to take on some of the challenges that we were facing pre-pandemic and put those on the back burner now that we are out of that woods, we have to we have to get to them really, really, really quickly.

“One important aspect I think we need to bear in mind is that COVID or the pandemic, the pandemic on the health side, and the economic crisis that came along with it, gave us, I think, a very unique window and a very comprehensive window where we can have a full assessment of the weaknesses and the vulnerabilities within the economy. A lot of these things we knew about, we talked about them, but we didn't fully I think totally appreciate how deep this could be.”

While the government tries to arrest the escalating debt, the hardship ordinary residents face is a more visible sign of present difficulties. A national Labour Force survey has not been produced since the start of the pandemic. One is however expected by the end of 2022. The rate will likely be far lower than at the height of the pandemic when government officials estimated a rate of +40%, but the figure is expected to still be much higher than the pre-pandemic unemployment rate level.

Mark Turnquest, president of the 242 Small Business Association and Resource Centre, a grassroots organisation advocating for small businesses, said the challenges have been compounded by recent global developments and chaos.

“We are at a crossroads trying to get out of the challenges of COVID-19 and trying to prepare for the future but the only problem is we still have a lot of challenges with the high rising costs, the delays (of products) and shipping costs, and of course inflation,” he said.

“Our problem is trying to stay in business with somewhat non-comprehensive national spending policies…there has to be some kind of strategic national funding mechanism in place to illustrate where the money is going to be earmarked.”

To respond to the COVID-19 era problems, Turnquest is encouraging the government to pursue legislation that will help empower small businesses. “Because we don’t have a Small Business Act, we are not understood…a National Development Plan which focuses on MSMEs and of course a national funding mechanism,” he said.

As the pandemic recedes, the economic output stands at 70% of its 2019 peak by the second quarter of 2021––“a noteworthy recovery by any measure”, according to former Central Bank Governor and chairman of the Private Sector Debt Advisory committee James Smith.

However, Smith said the borrowing prompted by the pandemic will cause challenges in the future.

“We lost a lot of ground and in order to stabilize the economy we relied heavily on borrowing from international agencies plus the capital markets so now we see the escalation of our debt approaching 90-100 percent of our GDP,” he said.

“More importantly and more troubling is that 40% of it is foreign debt. And to pay off foreign debt we need to have increased receipts of foreign currency that comes primarily from foreign direct investment and tourist expenditure and that’s unlikely to increase at the same rate at which we have to repay the debt. That to me would be our major challenge. And, of course, raising the revenue becomes a very delicate matter.”

Smith predicts that while economic growth will help, there will be no short-term return to normalcy.

“What I would’ve questioned and would’ve advised concerned the composition of the debt. I think the foreign debt ran up much too rapidly and, in some cases, it could have been avoided,” Smith continued.

Bay Street, Downtown Nassau as commercial activity picks back up slowly.

“We went out and borrowed foreign currency to settle our local debts and also to deal with issues related to the pandemic. We did this at a time when the banking system had a billion dollars in excess reserves, surpluses, and I think over that period we borrowed close to $2 billion, most of which was foreign.”

Smith added: “So it seems to me it would have been natural to tap as much as you can local institutions because we now have to repay foreign debt and we still have over $1 billion in our surpluses.”

The country maintained a healthy momentum during the first quarter of 2022, according to the Central Bank in its first quarterly economic review for the year.

“Tourism output continued to strengthen, buoyed by seasonal gains in both the high value-added stopover segment and the rebound in sea traffic, albeit remaining below pre-pandemic levels,” the bank stated.

“Further, a number of small to medium-scale foreign investment-related projects, as well as ongoing post-hurricane rebuilding works, undergirded activity in the construction sector. In price developments, domestic inflation increased, reflective of the pass-through effects of higher international goods and oil prices.”

Preliminary data for the third quarter of FY2021/22 demonstrated the Government’s overall deficit narrowed considerably, compared to the same period in the previous year. The Central Bank said the outturn was due to a VAT-led increase in total revenue that outweighed the growth in aggregate expenditure.

“Budgetary financing was secured from both external and domestic sources, including a mix of long and short-term debt instruments. In monetary developments, bank liquidity expanded, as the growth in the deposit base, contrasted with the reduction in domestic credit. Similarly, the accumulation in external reserves was attributed to net foreign currency inflows from real sector activities, and the further receipt of proceeds from Government’s external borrowings,” the Central Bank said.

It continued: “In addition, supported by loan write-offs and improving economic conditions, banks’ credit quality indicators improved during the review quarter. Further, the latest available data for the fourth quarter of 2021, revealed that domestic banks overall profitability levels increased, underpinned by a decline in operating costs and provisions for bad debt.”

Much of the government’s track to restoring country’s fiscal health focuses on containing expenditure and meeting a revenue target of 25% of GDP by FY2025/26.

In late August, the Ministry of Finance released a strategy document “Securing the Revenue Target of 25% of GDP” that set out how it expected to finance recurrent and capital expenditure while reducing the annual deficit in the medium term.

Notwithstanding the government’s political commitment to resist any increased tax on the public, there are considerable gaps in revenue collection that the government has set its sights on. The government has also hinted that it would be revisiting the costs of various user fees to match the costs of providing those services, and this exercise is expected to contribute to the government’s ability to meet its core revenue target through the medium-term.

According to the report, a central theme is heavy emphasis on revenue enhancement and improved tax collection, with specific focus on real property tax, VAT, customs duties, and excise taxes.

The country is also considering a corporate income tax following a 2021 agreement on a global reform that would set the tax at 15% on profits of multinationals with global turnover exceeding 750 million Euros.

The CIT tax could become a significant source of revenue; however, the government is also considering repetitional risks that may follow with not following through with the agreement concluded alongside some 133 countries.

Environmental taxes are also being heavily pursued. However, the country’s foray into carbon credits is not expected to generate significant revenue in the immediate short or medium term.

It goes without dispute that the country’s rebound is faring better than expected. However, its future is heavily reliant on the discipline and steadfastness of policy makers to ensure ambitious revenue targets are met.

“Yes, we have some challenges. But as far as the debt is concerned, The Bahamas has options and it has the ability to fix that in terms of, we don't really expect that at the end of the day, there will be a default,” Edwards said.

“But there are some important headwinds, and the government and the country, the private sector, the public sector, all persons involved need to recognize that, you know, business as usual maybe is not going to hold. We have to make quick decisions.”

Small entrepreneurs are returning to business with growth in mind.

Edwards continued: “And so, you know, the time for kind of, you know, delaying and dragging over feet and kicking the can down the road, I think is long gone. And if it's not long gone, certainly the crystallisation or the coming together of the multiplicity of issues which are affecting us, coming out of the pandemic on the back of Dorian certainly is sending a message that we have to embrace a sense of urgency. We have to embrace the sense of pragmatism. We have to be innovative, and we have to be serious about where we are going from an economic perspective.”

He added: “We have to now make deliberate and strategic interventions to ensure that monies are moving, and capital and wealth is being developed in vulnerable areas.

“Because, as you would appreciate, it was the regular guy on the street, the person who was living paycheck to paycheck, the individual who lost their job, who got really, really creamed during this pandemic situation. And so, the social safety net, the social side of national life, I think, is going to become important alongside fixing the economy for growth and development and effectively managing the debt circumstances that we are faced with.”

Nassau, June 11, 2022 (MIC) -

Pandemic Year 3: Race to rebound

The onset of the COVID-19 pandemic met The Bahamas significantly wounded, both economically and socially, by the ravages of catastrophic hurricane damage in 2019.

The Inter-American Development Bank (IDB) had estimated the destruction wrought by Hurricane Dorian totaled more than $3.4 billion. However, Prime Minister Dr Philip Brave Davis told Parliament the country has shouldered $4.2 billion in losses and damages since 2015. Davis referred to the deadly Category 5 storm’s impact as an “open wound”.

Consequently, as the country looks to mark the third anniversary of the storm’s passage, it is also entering its third year of the pandemic. And while most countries in the region are seeking to get back to pre-pandemic levels, The Bahamas must stretch even farther in hopes to achieve a pre-Dorian economic outlook.

This feat and the track to achieving it, according to economist Marla Dukharan, is compounded by social, economic, and environmental pressures that will have policymakers racing the clock to hit stability and growth targets before the impact of the extended crisis takes root.

With nearly 900 active cases at the start of June, the country has recorded more than 35,000 infections with both deaths (810) and hospitalisations remaining flat.

Although some health officials have confirmed the country has entered a fifth wave, there has been no tightening of restrictions as officials move full steam ahead on efforts to reinvigorate the tourism sector notwithstanding the emergence of cases on smaller Family Islands, which were previously unaffected for some time.

Mask requirements have been dropped for resorts and open spaces where there is social distancing. PM Davis signaled the government could move to completely drop the mask mandate by the summer; however, officials have since distanced themselves from the commitment and instead pinned further consideration for when cases begin to trend downward. Vaccinations have also plateaued with around 40% of the population having completed the initial protocol.

As a result of the stalled uptake, one batch of Pfizer vaccines expired last month, with another slated to expire at the end of August if rates do not increase.

Although COVID-19 hospitalisations have remained low, the nation’s leading hospital has repeatedly been overwhelmed due to the backlog of non-urgent surgical procedures that have been attributed to the COVID protocols and a nurse shortage.

At its onset, the pandemic exposed legacy inefficiencies and systemic shortfalls within the country. Some two years on, policy makers are seeking to repair deepening cracks in nearly every sector.

Dukharan argued: “I would say that the Bahamas is not yet out of the woods. Many countries in this region, however, support a position where we're not yet at 2019 levels of economic activity or I should say pre-crisis levels of economic activity. In the case of the Bahamas, we're thinking pre-Dorian levels of economic activity. We're absolutely not yet at that level.”

Getting out of the woods

The government reopened the economy in late 2020 as it sought to balance a brewing health and economic crisis as a tourism-dependent nation.

In an assessment as part of a loan guarantee proposal, Building A Social and Inclusive Blue Economy in The Bahamas (BH-U0001), the IDB pointed to the devastating impact COVID-19 has had on the Bahamian economy.

The $200 million project was approved on July 15, 2021, and is currently in the implementation stage. The IDB pointed to the contraction of the economy by 14.5% in 2020 due to the halt in tourism and subdued construction sector due to lockdowns.

“In FY2020/21 revenues fell 10.3 % due to subdued economic activity, compared to the previous fiscal year, while expenditures increased 9.9 %. COVID-19 related expenditures amounted to US$273 million (equivalent to 2.4 % of GDP) in that period and the fiscal deficit reached 12.1 % of GDP,” the IDB wrote.

The country’s debt-to-GDP ratio bloomed during the pandemic, according to the IDB, from 66.9 % in FY2019/20 to 104.7 % in FY2020/21.

It noted the 50 % target established by the Fiscal Responsibility Act by FY2030/31, supported by economic recovery and shrinking.

According to the IDB, the country’s current position remains vulnerable in the event of another climate hazard event. However, it highlighted four key pieces of legislation enacted in 2021: the Public Finance Management Act; the Public Debt Management Act; the Public Procurement Act; and the Statistics Act.

As a panelist in an economic forum hosted by the Organization for Responsible Governance’ (ORG), Economic Affairs Minister Michael Halkitis explained the 2022/2023 budget is a bid to directly address the social burden of high inflation, deepen linkages to the tourism sector through geographical diversification, and strengthen revenue collection to ensure targets for growth and reduction of the fiscal deficit are met.

Titled, ‘Budget 2022:The Way Forward’, the Davis administration has outlined its roadmap to economic recovery, healthcare resilience, widening the social safety net, and increasing Bahamian ownership in the private sector. The government is seeking to borrow $690,702,027 this fiscal year.

Notably absent from the government’s roadmap was the broadening of the country’s tax base, or any increases in taxes — a tool that has been repeatedly prescribed by international agencies, and that has been flagged by rating agency Moody’s as a key risk to projections.

The Bahamas received credit downgrades from Moody’s - Ba2 to Ba3 in September 2021; and S&P’s BB- to B+ the following month.

While the government’s revenue collection has offset increased spending, Moody’s noted the decision to pay off unsettled claims of $1 billion left by the former administration meant the government deficit only narrowed from 7.4% to six % of GDP.

On the part of social assistance, the government has announced a 50% increase in social services assistance over pre-pandemic levels, and a reduction in duty for a number of food items.

The conditional cash transfer programme known as the RISE program is also slated to be reintroduced. The RISE program was established by a five-year loan contract between the IDB and the Ministry of Social Services that ran from August 2012 to 2017.

Between July 2020 and March 2021, more than $43 million went towards food assistance. The government will spend $21.5 million on its food assistance program - well over pre-pandemic levels. In 2019/2020, just over $16 million went towards food assistance. Tariff cuts were a key element in the upcoming budget.

Duty-free items include: cheese, lettuce, salad, beetroot, turnips, cucumbers, peas and beans, asparagus, celery, sweet peppers, hot peppers, eggplant, spinach, pumpkin, corn, beets, artichoke, yams, cauliflower, broccoli, cassava, sweet potato and all preserved vegetables, yeast and baking powder.

Food store chain Solomons announces an immediate price reduction as a result of the government’s budget announcement on duty reductions.

In an interview with MIC, 32-year-old unemployed mother Sadaiska Allen spoke to the urgent need for an increase in minimum wage as residents grapple with rising food and gas prices.

Gas tracker: May 26, June 1, June 9.

Allen also expressed concerns over the stalled return to normalcy in classrooms.

Dukharan explained the erosion of spending power of Bahamian families represents a critical social threat.

Constraints relating to the ongoing pandemic, and the prioritization of the population census, has led to the absence of a labor force survey since 2019. The result is a unclear picture of joblessness in the country.

Diversifying the “Bread and Butter” Tourism Industry

Tourism arrivals in 2020 reflected just a quarter of traffic seen in 2019, according to the IDB. At this time, unemployment more than doubled from 10% in 2019 to 25.6% in 2020.

“Although in 2021 some cruise lines resumed operations, airlines reopened routes, and tourism activity gradually increased, the number of visitors was still well below pre-COVID levels,” the IDB wrote.

The pandemic continued to have a negative impact on the tourism sector in the first half of 2022.

Halkitis underscored the need to be proactive in using government agencies to connect Bahamians to opportunities and jobs brought on by foreign direct investment.

Is it too late?

While the government has been lauded for its ambitious targets and roadmap, the question remains whether it will have enough time to both launch these initiatives successfully and reap the benefits.

Given external pressures, like inflation and international agencies, alongside the advent of forecasted active hurricane season, Dukharan questioned whether the policies are several years too late.

Nassau, February 23, 2022 (MIC) -

By mid-February, The Bahamas flattened the curve of its fourth wave with a complete slowdown of new infections from a peak of 349 cases recorded in a single day (January 9) last month.

The rollout of the vaccine programme last March saw improved economic conditions, though far from pre-pandemic levels. By June 2021, more than 58,000 vaccine doses had been administered and that figure jumped to nearly 150,000 as of mid-November last year.

Forty percent of the population have been fully vaccinated to date; however, there is low expectation that the country will achieve 70% by the year-end due to vaccine hesitancy.

For a country with high comorbidities, the ongoing pandemic has largely discouraged Bahamians from accessing public health services for previously non-life-threatening illnesses that have become catastrophic due to nontreatment.

As the country and wider world adjusts to the new normal, Bahamian public health stakeholders are braced to continue to shoulder a deepening crisis due to the impact of the virus on the access and delivery of care, and the knock-on socio-economic effects of the virus to mental health and livelihoods.

Former Health Minister Dr Duane Sands underscored the high level of unmet medical needs in the country for non-COVID related care. He said it was comparable to the challenge facing the UK National Health Service, where reportedly well over six million people are waiting for care.

“We have seriously reduced capacity, in large part due to the impact on nurses, but it’s not just nurses,” Sands said.

“It is the system-wide challenge with capacity to manage the totality of the health care challenges being seen. If you look at the National Health Service in the UK, they have almost 7M cases on the waitlist now and while we don’t have seven million, a comparable level of unmet need exists.

“So, when you talk about the baseline health demographics of The Bahamas with severe hypertension, diabetes, kidney failure, cancers and you realize that many of those issues have not been dealt with.

When you look at that, it’s a sustainability issue, it’s a resiliency issue, and how do we move forward in tackling all of this unmet need.”

Much like global trends, the country’s fourth wave was propelled by the Omicron variant, which was highly transmissible but less deadly. The country’s COVID-19 mortality rate has remained low with just over 2% with 33,018 infections and 768 deaths.

In a bid to limit the spread of COVID-19, the public health system rolled out specific strategies that have significantly impacted the access to and delivery of essential services since the onset of the pandemic.

According to PAHO consultant Dr Keva Thompson, these include: the closure of outpatient services; cancellation of elective surgeries; repurposing of health workers to support the COVID response and contact tracing; changes in treatment protocols.

Thompson noted public health also strengthened its supply chain to ensure sufficient personal protective equipment (PPEs). Thompson confirmed health officials recorded changes in health-seeking behaviour of Bahamians - all of which impacted demand for care services.

“Patients in The Bahamas and globally, have had to delay care as the health system grappled with responding to the pandemic,” Thompson said.

“Individuals living with NCDS continue to struggle with accessing these services or must travel longer distances to see a physician (e.g., person living in the South Beach Clinic area).

The South Beach Clinic was redesignated as a COVID treatment facility.

Thompson added: “There are also persons fearful to return to the health centres. We want to implore persons to return to your regular appointments, it’s safe.”

Faced with overwhelming hours, coronavirus fatigue and being pressed to do the jobs of two to three workers on wards, nurses, doctors and other health professionals expressed that the healthcare sector had “fallen off a cliff” last year, amid the bitter and deadly third wave powered by the Delta variant.

At the time, Bahamas Nurses Union (BNU) President Amancha Williams said nurses continued to show up to serve the Bahamian people in their time of need, but they themselves were pressed to their limit, both physically and mentally.

Williams said: “Physiologically, it is playing a toll on you and on your mental status, which is very important. You can’t at the end of the day, if you can’t relate, you can’t function. It’s really serious.”

Hospitalisations had climbed to 147 up to that point, but those numbers almost obscured the pressures on the hospital from non-COVID patients.

Dr Sands said: “Clinics are not yet able to run at full efficiency and so you are going to see the impact of COVID on healthcare in The Bahamas for years and this is before you even start to consider the horrible impact on mental health. We don’t have anywhere near the capacity that we ought to have to deal with the fallout in mental health.”

“We’re watching it and we’re speaking about it in one-offs. We’re focused on the gender-based violence issue, and child abuse issue, but a significant percentage - as many as 25% of people with COVID, end up with mental health challenges. So, when you see that you have to realize that it’s a major issue and that we certainly haven’t tackled it.”

Sands added: “It’s more than just funding, it’s human resources, it is structural challenges, systems challenges, but funding is a huge part of it.

“There is a finite amount of resources, you do the best that you can with what you have, and it is not as simple as going into a store and saying I’ll take five of these, and six of these.

“There are Bahamians that do not want to come to The Bahamas and the single greatest threat is that we are losing our nurses because we are not treating them the way they should be treated, and we are losing them to the north and to the west and that problem has only gotten worse during COVID.”

Last month, the country welcomed forty-two (42) nurses from the Republic of Cuba. These nurses were deployed to the main hospital’s Emergency Department, the Surgical Department, and medical wards for an initial period of three months.

COVID by the numbers

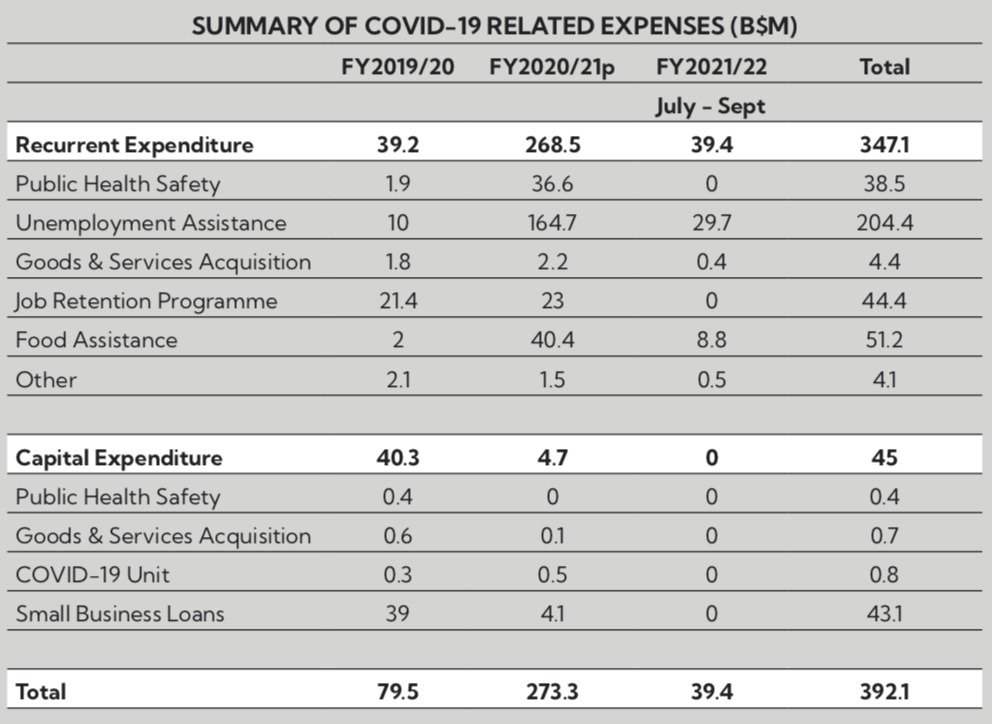

To date, the government has spent an estimated $400 million on COVID support.

Minister of Health Dr Michael Darville pointed out that significant resources have been allocated in the fight against the virus and without those resources, and the assistance received, the impact in The Bahamas would have been far greater.

As the pandemic reached the shores of The Bahamas, the government implemented measures to reduce the economic impact, focusing on public health and safety, job protection and social and economic support for households and businesses.

Its fiscal approach was adjusted to achieve this, with funds diverted to public health and safety.

This includes funds expended on the healthcare sector, small businesses and to provide unemployment assistance.

The government’s fiscal framework seeks to address losses in revenue experience through an “aggressive strategy” of collecting outstanding taxes, adjusting enforcement mechanisms, and implementing tax reforms.

An ambitious target is to build a new hospital by public private partnership.

The debt to GDP target remains unchanged and it is expected to be achieved in the next eight years due to elevated borrowing for COVID support.

Border restrictions and closure that impeded the movement of people and commerce saw The Bahamas experienced muted growth in 2020.

While The Bahamas had experienced 3% positive growth in 2018, it experienced negative growth in 2019 of 0.7 %, in large part due to the impact of Hurricane Dorian, which devastated portions of Abaco and Grand Bahama.

The following year, with the onset of the pandemic, there was negative GDP growth of 14.5 % — from $11.3 billion to $9.66 billion.

The economic fallout of the pandemic continues to be felt, particularly on tourism-reliant destinations such as The Bahamas.

Spending

In the fiscal period 2019/2020, the government spent nearly $80 million on COVID-related expenses.

The bulk of the expense was split between job retention programmes at $21.4 million and capital expenditure on small business loans at $39 million.

However, spending changed as the dynamic of the pandemic and continued closures saw unemployment levels rise to well over 25 %.

In response, the government spent over $164.7 million on unemployment assistance, $40.4 million on food assistance and just $4.1 million on small business loans.

The allocation for public health safety also jumped from $1.9 million in 2019/2020 to $36.6 million in 2020/2021 — and between July 2021 and September 2022, the government’s COVID-related spending was adjusted again.

While unemployment levels have been significantly lower, the economy has yet to return to pre-pandemic levels.

In recurrent expenditure, $8.8 million has been spent on food assistance during the period, while $29.7 million has been expended on unemployment assistance — a nearly 82% decline in spending.

With the general assumption that tourism will rebound to pre-COVID levels, GDP growth is projected 8.5% this year and 4% next year.

The fluctuations of waves prompted by new variants threaten these assumptions, the Ministry of Finance notes in its most recent Fiscal Strategy report.

However, the Ministry of Finance does not foresee additional COVID spending as it is believed there has been sufficient capacity built over the last two years.

The government expects the need for incremental COVID-19 health and safety measures and income support measures to be eliminated by the end of 2021/22.

And by the beginning of the next fiscal cycle, the government projects that funding for all forms of COVID-19 support would have fallen away.

For his part, Doctors Hospital CFO Dennis Deveaux believes the role of the private sector will continue to taper off as capacity continues to build in the public sector. He noted that the private sector is also experiencing hesitancy from the public to come forward to treat non-COVID related illnesses.

Deveaux said the private sector remains on hand to address overage amid fluctuations due to new variants or waves of COVID-19.

Nassau, December 17, 2021 (MIC) -

With an alarming 30% of school-aged children flagged for low or no attendance on virtual public education platforms, the disruptive and destabilising impact of the COVID-19 has not spared the nation’s youth.

Pandemic conditions have exacerbated economic inequalities among parents like access to income, food, and digital technology that engender harsher consequences for children - whom officials fear are at risk of falling through the gap.

This report focuses on the impact COVID-19 has had on the livelihoods of children in The Bahamas by examining health and psychosocial statistics, disruptions to academic and athletic scholarship, and stakeholder concerns.

In recent weeks, the country’s test positivity rate has trended below the five per-cent WHO benchmark, and the number of new cases recorded in the last month reflect the lowest for the year.

However, officials are concerned about the number of COVID deaths, with 708 confirmed and another 36 under investigation as of December 9. The total number of COVID-19 infections stand at 22,881.

And though numbers are low, the emergence of the Omicron variant has heralded an increased level of caution despite the removal of curfew and full opening of the economy.

Minister of Health Dr Michael Darville has informed Parliament that officials anticipate a fourth wave and are working to recruit additional healthcare workers and introduce medicines that will prevent persons from requiring hospitalisation. Other initiatives include the continued rollout of free COVID-19 testing and an increase in COVID-19 contact tracers.

Just over 138,000 people were fully vaccinated at the end of November, with an-other 151,709 receiving at least one dose. However, flagging numbers have prompted officials to establish a vaccine lotto to entice residents to get the jab.

The country’s third wave was characterised by a growing trend of more young people and adolescents contracting the virus. According to then-Health minister Renward Wells, people 40 years and older represented the majority of cases in the first wave and that trend shifted to 49 years or younger in the second wave.

As of December 10, National COVID-19 Vaccine Consultative Committee Deputy Chair Ed Fields confirmed that 10,400 minors have been fully vaccinated in The Bahamas since the rollout of Pfizer in August.

At home

Some 57,000 families were reliant on the government’s food assistance programme during the height of the pandemic last year with that figure resting at 18,000 families when the programme was shuttered in October.

Those households are to be absorbed by the Ministry of Social Services with charitable organisations estimating there are still about 9,000 families in need of food aid. COVID-19 unemployment benefits were extended into December with total payouts exceeding $200 million at the end of September.

These socio-economic conditions have led child rights advocates to sound the alarm on the prolonged, close contact children in abusive homes now have with their abusers and the lack of protections for them.

Officials have correspondingly flagged an uptick in reports of domestic and child abuse several months into the pandemic.

Former Social Services Minister Frankie Campbell said 116 cases of alleged child abuse were reported to the Child Protection Unit, Department of Social Services, and by national hotlines in 2020.

Last month, Minister of State of Social Services and Urban Development Lisa Rahming highlighted that the reporting of child abuse cases plummeted more than 70 percent between 2018 and 2020.

There were more than 600 cases in 2018, but just over 100 cases reported in 2020.

Local experts believe that three out of every four victims of sexual violence do not report the matter to police.

The Bahamas began the year still under a state of emergency and new infections seeing a significant spike.

Though the country’s protocols were seen to be less restrictive than throughout last year, the Child Protection Unit saw an increase in reported cases. There were 335 cases reported to the unit between January and October with data revealing that neglect accounted for the majority of cases.

It cannot be concluded at this time whether this increase reflects a rise in abuse or a rise in reporting incidents.

“I believe this pandemic has placed a toll on so many parents and kids at the same time,” said Carlos Reid, youth mentor and community organiser.

His organisation, the Hope Center, is part of a network of facilities that provide resources for suspended students and at-risk youth.

Reid continued: “Kids are naturally designed to play to get out of the house but during this pandemic they have been locked down and its causing frustration.”

“It’s causing frustration for adults. It’s causing frustration for young people. This is a problem we are going to have to deal with over the next several years, we are seeing where there are more domestic violence. We are seeing more and more where young people are having to be counselled because of the stress, because parents are home and they stressing the kids out,” he said.

Reid added: “I believe even as we rebound from this COVID-19 pandemic we are going to have to pay some attention and put some good investment in how we restore the mental capacity of the young persons and their parents as well.”

Carlos Reid of the Hope Centre has noted an increased need for youth counselling.

Classrooms

Anecdotally, youth activists believe the increase in child abuse cases throughout the pandemic can be correlated to the discontinuation of face-to-face learning and the removal of institutional capacity to intercept abuse by observing red flags in children’s behaviour.

All educational campuses were closed in the country on March 16, 2020 and public schools have yet to return to full face to face learning.

In order to provide access for the continuation of learning, the government established a Virtual Learning Platform for all students within country from pre-primary through to secondary during the outbreak.

The site was activated on March 23 with content for all students of all grade levels.

However, education officials have pointed to the fact that a reliance on digital learning tools has widened the learning gap due to lack of access to devices and proper internet connection, among other challenges.

A month following last year’s closure, Former Minister of Education Jeffrey Lloyd revealed that less than 30% of students in the country had registered for the Virtual Learning Program. Lloyd also noted that attendance dipped significantly after the first week.

The 2021/2022 academic year began virtually with technical challenges once again being seen in the government’s learning management platform. However, officials reported that attendance levels sat at around 70% for the online platform.

Minister of Education Glenys Hanna-Martin recently described the public education system in The Bahamas as being in a “state of crisis”, due to those issues with the system.

“Throughout this period, in the last almost two years, thousands of children have been fully absent from school and have never logged onto the virtual platform,” Hanna-Martin said in the House of Assembly.

“And there are many who have logged on, including teachers, who say they have experienced challenges and frustrations on the virtual platform.

“The children who have been absent from school for this period will have undoubtedly suffered significant learning loss, which, if not remediated, is likely to have serious detrimental effects on the individual lives of each child and on our collective state as a nation.”

The government has announced that all public schools will return to a hybrid model as of January 11.

The question remains how this loss of learning will impact students in their ability to succeed in tertiary education and enter the work force; and whether National Examinations are adequate to reflect this setback.

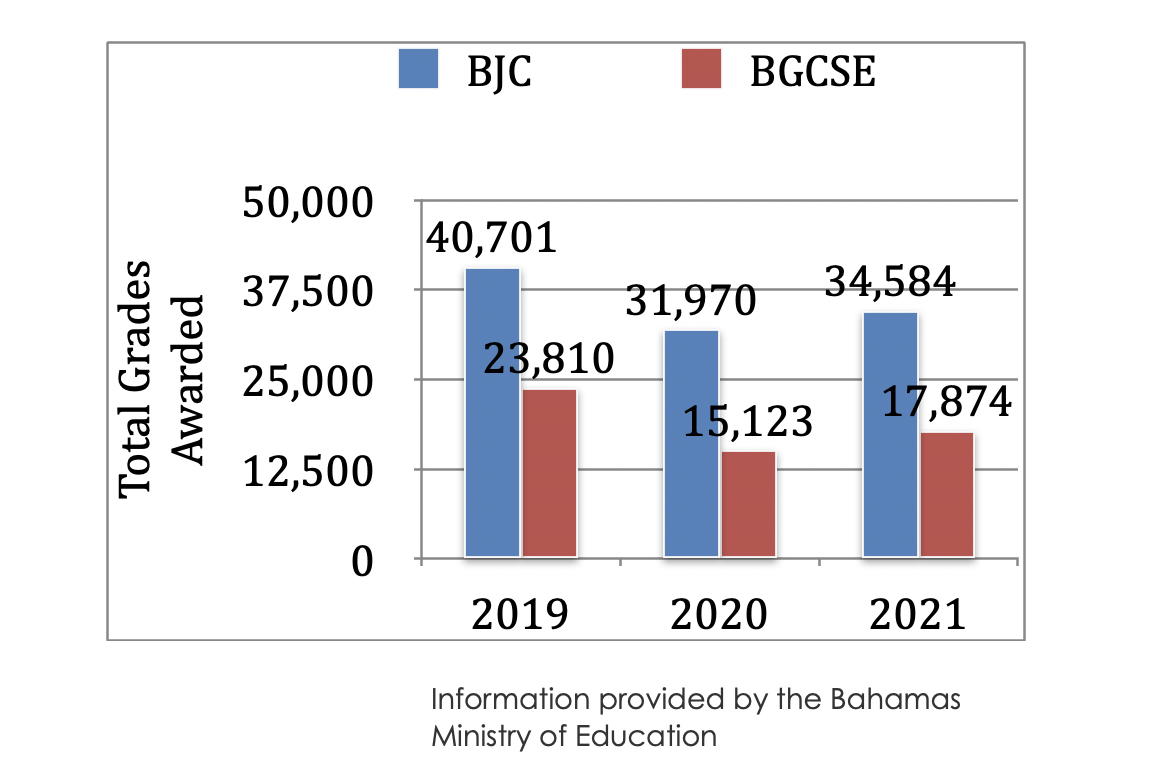

The number of grades awarded for the Bahamas Junior Certificate (BJC) and the Bahamas General Certificate of Secondary Education (BGCSE) dropped in 2020 by 22% and 36% respectively. In 2021, those numbers increased some 8% for BJC and 18% for BGCSE.

“I think people were scared at one point,” said Mona Pratt of the Student Refocus Program.

Pratt is part of a government subsidised programme that places suspended students in a facility for counselling and academic remedial work.

Since COVID, the programme has been adapted to take in students in need of resources to participate in virtual learning.

“A lot of the children still don’t see it as affecting them. A lot of the things affecting the kids are limited resources like electricity, a lot of the kids they buy data. It’s for entertainment, to stay connected,” Pratt said.

“Some of the kids we get, the schools would refer some of the higher flyers stu-dents with high GPA but who are not performing because no internet. Then we have some girls and what is affecting them, with some of them it’s just family dynamics. The challenges with limited resources, we’ve had parents who couldn’t pay rent due to not working and unemployment. And a lot are working and can provide for basic needs.”

Public school teachers are increasingly concerned about their ability, even when in-person learning returns, to get students up to speed and have expressed a need for additional ancillary programs, like that of Pratt’s but on a larger scale.

The learning gap is less severe in the private sector due to the majority of students coming from middle to high/income families, but it is not without its challenges.

Another consequence of COVID-19 was the impact on athletic scholarship opportunities for Bahamian youth.

Corrington Maycock, Blue Chips Athletics founder, said: “Last season (2020) we were held back by so many curfews and progression was hampered extensively. Although my athletes did well, they would have had a greater opportunity to be lights out this season if it was not for COVID-19.”

Maycock continued: “We had limited practice and weight room opportunities until the latter part of the season. I must say clubs made it possible as well as the Bahamas Association of Athletic Associations (BAAA) to host meets and keep some of our junior athletes competing.”

“When we speak about junior athletes here in The Bahamas obtaining scholarships, it’s a way out and also to help their parents out financially.”

Nassau, October 18, 2021 (MIC) -

By mid-October, there was evidence that the latest wave of the coronavirus, after spiking at the end of July and into September, but in the number of cases and fatality rates had begun to decline. In its October 7 report, the Ministry of Health and Wellness said there were just over 1,100 active cases and a death toll of 590.

Vaccination figures on October 15 established that 28% of the vaccinable population had received a full course of vaccines and another 5.8% a first dose of a two-dose regime.

While the country has not experienced food shortages to date, The Bahamas’ heavy reliance on food imports - to the tune of US$1 billion annually, continues to drive its pandemic experience on the question of food security.

The country continues to shoulder the global impact of COVID-19 that has affected widespread labour shortages, manufacturing and shipping delays, and rising energy costs in major markets.

The country also elected a new government on September 16. The country’s commitment to reducing the country’s heavy food bill remains a top concern as projections indicate the current track is unsustainable.

Newly-installed Minister of Agriculture, Marine Resources and Family Island Affairs Clay Sweeting said the country currently produces just 8% of its domestic market needs, adding that figure is expected to drop by half over the next five years.

The incoming administration also announced the end of the National Food Distribution Task Force, which at its peak registered 57,000 households last year and represented a total investment of $54 million.

Some 18,000 households were reportedly still being assisted by the Task Force, with the program reportedly costing the government nearly $800,000 per week to run. At the last report, 4,000 people have been absorbed by the Ministry of Social Services from the shuttered program.

This report examines the pandemic’s impact on the country’s agricultural sector based on an analysis of import/export data and anecdotal reports from industry stakeholders.

While the experiences of major retailers are more self-determinant due to their ability to directly engage suppliers, smaller retailers are extremely limited in their ability to circumvent shortfalls.

Courtesy Supermarket manager Macnair Beneby said: “We depend on wholesalers to get inventory. There is a shortfall of items when we order stuff, items are coming out of stock. It’s like a trickledown effect, I’m not talking about bigger retailers who import their own stuff but the smaller independent stores who have to depend on local agencies to replenish supply.

(Photo: Courtesy Supermarket)

Beneby said: “We notice a lot of items, they are catching up now, but it was kinda scarce during the peak months of last year, even the beginning of this year.”

“Even now, if you see the shortages are basically worldwide, all those container ships stuff off the coast of California that’s either food or the ingredients to make the food so eventually it would trickle down to us. America will look after America first, they will export what’s left,” Beneby added.

At the ministerial level, the government is not directly monitoring the impact of COVID-19 on the sector due to several limitations, namely digitisation and staffing. Agricultural Programme Officer within the ministry’s Policy, Planning, and Research Unit, Jeri Lee Kelly, explained the unit has plans to establish a database for monitoring.

Kelly said: “Our food supply chain has not been directly impacted even though it may seem that way because of the long lines in the stores but we were never out of food, we were never short of anything.”

And while the country has not experienced local shortages, global disruptions in labour and transportation systems have had a trickle-down effect on buying trends and the price and availability of certain goods.

The United States remains the country’s largest trading partner, and the consumer price index there hit a 13-year high in September. In its Monthly Economic and Financial Developments for August 2021, the Central Bank of The Bahamas stated it expects inflationary pressures to remain contained, although some firming is estimated due to the uptick in international oil prices.

Back at home, the head of one of the country’s leading food retailers, Super Value, has decried the impact of disruptions to the supply chain.

In an interview with a local daily, principal Rupert Roberts forecast an eight to 10 % hike in Christmas prices - though not “across the board”. He further expressed concerns over backlogs, shortages, and shipping delays that are expected to impact holiday inventories and drive prices up.

Roberts said: “We’re watching it very carefully and taking steps to ensure that that won’t happen to us. We’re trying to stay ahead of the supply chain. We’re trying every minute of the day. We’re trying to avoid that. The pressure on freight; every time you turn there’s an increase in the price of freight and a slowdown in freight. What would take one month now takes two, and what took two months takes four. The price increases and delays on freight are affecting everything else.”

Roberts added: “I don’t anticipate any problems between now and Christmas. We have planned the time, and we should get it on time. We are more flexible than the agencies. We can juggle around. We can go to different Florida suppliers.”

Bahamas Price Control Commission chairman Danny Sumner explained perceived shortages at food stores were due to consumer over-purchasing. He pointed to the fact that in the first few months of the pandemic there were also delays in supplies.

Sumner said: “Due to COVID-19, which started two years ago, there have been a major increase and demand for food items due to the fact that some stores, some factories in the US and within Canada were closed down because of COVID-19, and then on reopening the availability and the demand for certain things caused prices to go up.

“In that same vein, we have seen a drastic increase in gasoline prices also due to COVID. So, when you combine the amount of fuel price going up, food price automatically goes up because there is an increase in shipping, handling, and increase in transportation.

“Gas prices is one of the main factors in prices that would affect food stores throughout The Bahamas.”

Sumner said the country has experienced shortages of eggs, chicken, and at one point alcohol. He pointed to meats and cereals as experiencing the greatest pricing fluctuation, adding imported produce like grapes as well. He said impacts to pricing experienced during the height of the pandemic last year seem to be leveling off.

“Another thing is availability and demand, if something because less available the price becomes higher because people need it,” Sumner said.

In 2020, The Bahamas imported more than $487 million worth of food and agriculture products — a cost that has been labeled an “economic leakage” that could be plugged with greater focus and partnership from the government and private sector. Such imports ranged from live animals, meat, fish and crustaceans, to dairy products, vegetables, fruits, and salt.

Top on the list was meat and edible meat offal, which account for $69.9 million of The Bahamas’ import bill last year, compared to the $96 million imported in 2019 — a 27 percent drop-off.

The widespread destruction on two of the country’s largest islands of commerce — Grand Bahama and Abaco — and the humanitarian response and aid that followed after Dorian could shed some light on the lowered import of meats in 2020.

A look at imports of beverages spirits and vinegar amounted to $59 million in 2020, a significant drop off in comparison to the $86 million worth of beverages and spirits and vinegar in 2019.

It is important to note, that the former administration, under the public state of emergency and emergency orders mandated the closure of non-essential business last March, and even when some commerce was re-introduced, bars and liquor stores were left off that list as a policy decision due to cultural norms associated with liquor, socialising and intoxication subverting the health measures in place.

But imports of these goods were well over $300 million in the last four years: $338 million in 2018; $331.9 million in 2017; $306 million in 2016; $314 million in 2015 and $294 million in 2014.

Preparation of cereals flour starch or milk pastry products and miscellaneous edible preparations cost the nation $45 million and $44.2 million respectively last year.

This represents decreases of 21 percent and over the previous year.

Preparations of cereal flour starch or milk pastry cooks products represented $56.1 million in imports in 2019.

In 2019, The Bahamas imported $25.4 million worth of salt Sulphur earth and stone plastering materials; $50.6 million of edible vegetables and certain roots and tubers; and $39.5 million on edible fruits and nuts peel or citrus fruits and melon.

The country spent $19.8 million for salt Sulphur earth and stone plastering materials lime and cement last year — a reduction of 22 percent.

Another $37 million worth of edible vegetables and certain roots and tubers were imported year, representing a decrease of nearly 27 percent over the previous year.

Meanwhile, $31 million was spent on importing edible fruits and nuts or citrus fruit and melon in 2020.

This represents a pullback on importation of the product by 21.5%.

On the export side, The Bahamas shipped off $71 million worth of fish and crustaceans, mollusks, and other aquatics invertebrates last year, a decrease of 12 percent over the $81.1 million in 2019 and $81.2 million in 2018.

The Bahamas has acknowledged that there is no quick fix to food security and that the process requires methodical implementation of targeted policies and initiatives, combined with a mixture of incentives for farmers and entrepreneurs, down the line to packaging and packing houses.

The agricultural sector has faced an unprecedented couple of years, affected by Hurricane Dorian in September 2019, and the ongoing global pandemic.

Farmers were initially impacted by COVID-19 restrictions but were quickly issued approvals to allow them to attend to their farms and livestock and sell their products both to direct markets and farmer’s markets.

According to Minister of Agriculture and Marine Resources Michael Pintard in his 2020/2021 budget contribution, permits for importers of fruits, vegetables, meats, eggs, poultry, and dairy increased over the last two years.

For example, for the first three months of this year, there were 1,059 applications for permits to import fruits and vegetables, compared to the 3,574 applications processed in the entire of 2020.

The government rolled out its agriculture and marine resources emergency food production plan at the start of the pandemic last year. It featured a $1.7 million land clearing initiative and incentives that provided farm inputs, and access to hydroponic systems and shade for producers, focusing on young farmers and backyard gardeners.

As a result of the storm in 2019, fishers were displaced on both impacted islands — Abaco and Grand Bahama.

In the case of Abaco, there was a 36% drop in the landing of the total fishery product for the island in 2019 when compared to 2018.

In 2020, total fishery product landings on the island decreased yet again by nearly 17%.

One of the major seafood processing facilities and the main buyer of seafood products on that island was destroyed during the storm, leaving a major gap in the food supply chain for fishers.

In Grand Bahama, the initial decrease of the fishery landings was 59% in 2019 compared to the previous year, but in 2020, the island experienced a nearly 80% rebound despite the pandemic and the island recording the second largest portion of cases.

In the 2020/2021 budget, the former Hubert Minnis administration allocated $5 million for Food Security.

In his budget presentation, Pintard said: “This is in and of itself shows the government’s commitment in this regard and will allow the ministry to advance its plans and projects to enhance food security and food sovereignty in the Commonwealth of The Bahamas.”

As part of the investment, the then minister announced plans to update the Department of Agriculture farmer database, create geospatial maps of farm locations on the various islands to aid in extension and planning; create a livestock survey of farmers and crop forecast survey to determine the country’s livestock.

He also introduced a new concept coined the AgroVillage Smart Farms — a system of agricultural technologies within a cluster of units such as production systems, food processing, labs, research and development, retail services and other social activities to promote a healthier food culture.

The former Cabinet agreed to designate 25 acres of GRAC for the establishment of the AgroVillage Smart Farm and contracts were issued for surveying the land.

For Caron Shepherd, president of the Bahamas Agro Entrepreneurs Group, the pandemic has forced the country to reckon with its longstanding nutrition insecurity.

The group has swollen to 250 farmers since its 2019 conclave, launched in partnership with the Caribbean-Israeli Leadership Group.

Shepherd noted the public has responded positively all-natural, organic fresh fruit and vegetables at farmers market, and called for higher tariffs or moratoriums on imported items so that local farmers can sell their items at a more reasonable cost.

A final verdict on the efficacy of this and other interventions is awaited. For now, the challenges persist.

Nassau, August 5, 2021 (MIC) -

The expectations of Bahamian health officials for the country to reach herd immunity by August 2021 have been sidelined by the lack of access to vaccines and, even further, by an insistence by nationals that they have a choice of vaccine.

In June, Minister of Health Renward Wells had set the goalpost at 120,000 people vaccinated, in order for the country to be in good standing, and further estimated the country could reach herd immunity by August. However, at a recent press conference Chief Medical Officer Pearl McMillan said the figure rested at 70 percent of the population — some 389,482 people.

Since the first jab was administered in March, less than 15 percent of residents have been fully vaccinated. Other factors fueling vaccine hesitancy include widespread misinformation and uneven support from the medical community and other leading socio-cultural groups like the religious community and civil society.

However, with nearly 2,000 active cases at the end of July 2021, and 100 of those cases currently hospitalised, there is now more local demand for the vaccine than there is supply.

Vaccinations over time

While a range of restrictions has been reinstated due to the surge, other incentives remain in place like indoor dining, an exemption from RT-PCR COVID-19 testing, and a US$10 health visa charge for travelers. Unvaccinated diners must be served outdoors or utilise curbside/takeaway services.

There has been no confirmation that the Delta variant is in the country. However, testing has proven the presence of Alpha and Iota variants. The latest surge, and reports that vaccinated people are less likely to become hospitalised and die from COVID variants, has coincided with an uptick in demand for the vaccine.

However, the country is currently experiencing a shortage as it waits for another tranche from the COVAX facility and potential donations from other countries like the United States.

The Bahamas government pre-paid for its doses through COVAX as one of the higher-income countries in the grouping. PAHO-WHO Representative Dr. Eldonna Boisson explained that due to the income level of The Bahamas, the country is classified as a self-financing country with respect to COVID-19 vaccines via COVAX.

“So, the country pays for vaccines accessed through COVAX,” Dr Boisson said.

"Vaccines for lower-middle and low-income countries are paid for through the COVAX financing mechanism. However, COVAX strives to achieve equitable access to COVID-19 vaccines to all countries, regardless of income level.”

She continued: “The Bahamas has been timely in preparing plans for the receipt of vaccines, signing of agreements, and making payments to facilitate the purchase of vaccines through COVAX.

“There has been limited availability of vaccines globally, which has resulted in vaccine inequity. However, with additional vaccines gaining WHO EUL approval and increasing donations from countries with excess doses, it is anticipated that much more vaccines will become available to The Bahamas between now and December.”

The coalition led by the World Health Organization (WHO) and Gavi (Vaccine Alliance), initially advised that “The Bahamas could receive 100,000 doses of the AstraZeneca vaccine, starting the second half of February through the second quarter of 2021.”

The country actually received its first batch of vaccines via a donation of 20,000 doses of AstraZeneca from India in March. Vaccines from COVAX came later that month, with 33,600 doses of the AstraZeneca/Oxford vaccine delivered on March 31.

The second tranche of 33,600 AZ vaccines from COVAX was received on May 11. The country also received donations of 5,000 AZ vaccines through an exchange with the Government of Antigua and Barbuda (June 24), and 3,496 AZ doses as the result of a donation from the British Overseas Territories of Montserrat and Anguilla (July 21).

Health officials said the country had expected to receive a balance of 33,600 AstraZeneca doses from COVAX on July 26, and 57,330 doses of Pfizer through the facility at an unspecified time. The Bahamas has also received an offer from the United States, through the CARICOM health agency CARPHA, for additional COVID-19 vaccines. The government has advised that this process is underway, though The Bahamas has not yet received a specific timeline for delivery.

The government’s vaccination rollout began in March with the first person to be inoculated being Public Health Nurse Ruth Bastian. It was initially distributed on the islands of New Providence, Grand Bahama, Eleuthera, and Abaco, and in the first tier offered only to frontline workers and the elderly. It was opened up to all residents aged 18 and older on April 26.

One of the major challenges foreseen by health officials in its vaccination distribution is the country’s archipelagic makeup, having to service 15 populated islands. The country was assisted by the U.S. Embassy in Nassau to distribute vaccine doses to the Family Islands by providing aircraft and crew along with the use of specialized equipment to transport vaccines for two joint missions in April and June this year.

US Embassy assists in vaccine distribution to Family Islands

Well ahead of the arrival of the first batch of AZ vials, speculation over the safety of a possible COVID-19 vaccine emerged as international media coverage over the lightning pace of research and clinical trials flooded social media. The government’s National COVID-19 Vaccine Consultative Committee was formed in January, which includes stakeholders from the public and private sectors, as well as community and religious leaders.

At the time, there was widespread speculation among frontline workers, including health and the armed forces, in January. This continued well into March, with the Consultant Physicians Staff Association (CPSA) - a national grouping of senior doctors - expressing concern that it was in the dark as it relates to the procedure of the vaccine rollout, and adding that its members were on the fence about taking the vaccine. At the time, international medical reports concerning rare side effects of blood clots associated with vaccinations created local anxiety and fueled hesitancy.

Covid Vaccinations Weekly Progress July 31

COVID-19 vaccinations are currently non-mandatory, and the government has maintained it will continue to be a personal choice for residents. In the private sector, some businesses have been incentivising workers by mandating that unvaccinated employees pay for weekly testing, and giving priority to vaccinated workers.

In The Bahamas, children under one year of age are vaccinated against Diphtheria, Pertusis, Tetanus, Haemophilus Influenza type b (hib), Hepatitis B and poliomyelitis. At age one, children are inoculated against measles, mumps, and rubella. The yellow fever vaccine is required if traveling from a country where the illness is endemic. Minister of Education Jeffrey Lloyd said private schools will have to make arrangements with parents and students if they plan to mandate COVID-19 vaccinations.

For its part, the government has urged residents to get vaccinated by underscoring the dangers of the new stronger variants, and the limited capacity of the country’s healthcare network to respond to COVID surges.

In a recent address, Prime Minister Dr Hubert Minnis advised the government is also exploring the use of cruise lines to help get more Bahamians vaccinated. In a private initiative this month, some 120 residents from Bimini traveled free to Florida on the cruise line Balearia to receive the Johnson & Johnson vaccine.

Another notable impact on COVID-19 management and vaccinations is the political environment. The country is an early election cycle with high speculation that the next general election will be called sometime this year. The government has restricted door-to-door political campaigning to only vaccinated individuals due to the recent uptick in cases.

However, a recent online survey purported to show the impact of political rhetoric/bias on COVID-19 vaccinations. According to the data by polling firm Intel Cay, people who identify as ruling Free National Movement (FNM) supporters are three times more likely to take the jab than people who identify as opposition Progress Liberal Party supporters.

With a sample size of 1,912, some 68 percent of respondents said they did not intend to or were unsure they will take the vaccine. Across age and income, people over 45 were 15 percent more likely to take the vaccine than those younger than them - and that likelihood increased with income and education level.

Nassau, June 15, 2021 (MIC) -

By mid-June, The Bahamas had begun to slowly re-emerge from a third wave of the coronavirus with just over 12,000 total infections, and close to 750 active cases (as at June 14). There were 239 deaths resulting from the virus.

More than 50,000 Bahamians and residents had by then received a first dose of the AstraZeneca vaccine, with some 10,000 being fully vaccinated.

The economy continued to experience severe difficulties and, on May 26, in his national budget statement, Prime Minister Dr Hubert Minnis acknowledged that the previous fiscal year had been “almost entirely defined by the need for an immediate and impactful emergency response to the COVID-19 pandemic.”

The country’s pandemic measures had exceeded US$290 million – a cost not inclusive of lost tax revenues - and greatly slowed general economic activity

Within that context, the country resorted to a World Bank US$100 million COVID-19 Response and Recovery Development Policy Loan on May 25.

The decision was considered to be historic by economist Marla Dukharan, who noted the bank “typically does not lend to countries which have ‘graduated’ based on certain criteria.”

Tahseen Sayed, World Bank Country Director for the Caribbean, said: “The exceptional support is in recognition of the extraordinary situation, as The Bahamas suffered major job losses and one of the highest GDP contractions in the region; and all this on the heels of the damages and losses caused by the 2019 Hurricane Dorian.”

“It is extremely rare for a graduate country to receive IBRD financing, even on an exceptional basis.”

Sayed continued: “The last time exceptional financing was provided for an IBRD graduate was in 2008 in the wake of the Global Financial Crisis. Since the onset of the COVID-19 crisis, the World Bank has provided over USD800 million in financing for COVID-19 response and recovery in the Caribbean (for 12 countries), of which over USD200 million is in the form of concessional financing for the small island economies of Dominica, St Lucia, St Vincent & the Grenadines and Grenada; and for Haiti and Guyana.”

According to the bank, the Development Policy Loan will provide assistance to “enhance COVID-19 relief and resilience, strengthen financial stability and the business environment, and improve fiscal sustainability and resilience.”

The statement also advised that the loan would support measures like unemployment benefits and food assistance to COVID-19 impacted workers and households, and measures to develop an inclusive vaccination policy.

“It also supports reform actions undertaken by the country to expand coverage of deposit insurance, strengthen the crisis management framework, strengthen public financial management, and improve governance of the Central Bank,” the Bank added.

During his budget communication, Minnis advised that the government had invested: US$25.9 million on COVID-19 public health and safety measures; US$118.0 million in government-funded unemployment assistance - separate from the National Insurance Board’s ordinary unemployment benefits programme; US$32.8 million in social assistance; US$44.4 million in the government’s payroll support programme; and US$53.3 million in business continuity support to Bahamian entrepreneurs and small businesses.

Minnis noted the cash injection for social assistance largely funded the extensive food assistance programme supported jointly by the government and NGOs. He said the payroll support programme contribution allowed private businesses to use tax credits to pay their employees and saved approximately 15,000 private-sector jobs.

Also in May, the IDB released more documentation on an upcoming US$140m project loan currently in the preparatory stages aimed at “Boosting Resilient and Inclusive Growth in The Bahamas II”.

In a supplementary report, the IDB released preliminary findings that indicate only 298 out of 557 micro, small and medium-sized (MSME) businesses stayed in operation after receiving funding to do so through a business continuity programme. Thirty-four per cent of those firms were headed by women, according to an article published in The Nassau Tribune.

“To support MSMEs during the COVID-19 crisis, a Business Continuity Programme (BCP) was executed by the Small Business Development Centre (SBDC), allocating US$30m in loans to small businesses, ranging from US$5,000 to US$300,000 as well as grants for payroll assistance,” the IDB report said.

“The programme is targeted to formal MSMEs, with the requirement to retain at least 51% of employees and share their credit performance with the credit bureau and other financial institutions. Preliminary findings show that the continuity rate of beneficiary MSMEs is 54% (298 out of 557), with a retention rate of 56% of employees on average.

“Of the continuing firms, 56% (168 out of 298) managed to retain 95 % of employees on average. The remaining 44% of continuing beneficiaries retained 30% of their employees on average.”

The SBDC also included a programme to encourage and support business registration, which assisted 50 % of beneficiaries to formally register their businesses.

The IDB noted the continuity programme experienced difficulties regarding the monitoring and evaluation of its beneficiaries. Among other challenges, it also highlighted the administrative records for firms have different identification numbers in each relevant institution, such as the National Insurance Board (NIB) and the Department of Inland Revenue, and the need for a strengthened system with quick access to the control variables at those institutions.

However, during the prime minister’s 2021/2022 budget communication, he said more than 1,000 small businesses were approved for loan and grant financing as part of the government’s COVID-19 programme.

He said the initiative administered by the Access Accelerator Small Business Development Centre or SBDC, represented a collective $45m allocated and disbursed.

Nassau, April 8, 2021 (MIC) -

By the end of March, The Bahamas had recorded 9,1718 COVID-19 cases and, even with 300 active cases, health officials were reporting early signs of a third wave of infections. https://ewnews.com/third-wave-incoming-health-experts-concerned-about-possibility-of-another-coronavirus-wave

A full year on since its first case, the country’s vaccination programme began on March 14. https://ewnews.com/reinforcements-covid-19-vaccines-from-covax-facility-touchdown-in-the-bahamas

More than 7,000 people had received their first dose of the vaccines by the end of March. From India has come 20,000 doses, and 33,600 secured through the World Health Organization (WHO)/Pan American Health Organization (PAHO) COVAX Facility.

Pan American Health Organization (PAHO)

The lion’s share of PAHO’s efforts in The Bahamas has been through technical cooperation, capacity building and the procurement of supplies. As such, officials contend it is difficult to capture those efforts in a dollar figure due to the emergent nature of aid, and the fast pace of response to fill gaps during the pandemic.

As part of a CAD$5 million grant from the Canadian government, PAHO allocated US$538,738.25 to The Bahamas in 2020 for the procurement of COVID-19 supplies and technical resources. The organisation outlined those efforts included: the development of an online Contact Tracing Course; the procurement of Personal Protective Equipment; and the donation of COVID-19 laboratory test kits. In March 2021, PAHO handed over a donation of 1,020 COVID-19 tests secured via the grant, to the Ministry of Health and Public Hospitals Authority.

An interview with PAHO’s country representative Dr Eldonna Boisson revealed that the organisation had implemented an incident management system team in January 2020.

This team combines expertise on surveillance, vaccine, information dissemination and analysis, logistics, and contains a budget and planning pillar. While the team produces reports; Dr Boisson said there is no direct mandate to make reports on funding efforts accessible to the public.

She remarked it was “nearly impossible” to quantify PAHO’s COVID response in the region in fiscal terms but insisted there has been no wastage or return of funds to donor countries.

Dr Boisson said: “It’s not just monies that might be spent to purchase items. It’s also human resource time, it's also time done by trainers, it's also the additional support that we are getting from headquarters.

“So, for example, in terms of facility in the procurement of Covid-19 vaccines through COVAX, there are a lot of different departments in headquarters who are working to facilitate that process. And they may not be working on just Bahamas alone.”

Dr Boisson continued: “So to be quite honest with you to get that figure it's going to take time and it's not something we are doing on an ongoing basis. Because it just takes too much time to add it all up and it’s just a busy time.”

At the end of March, the Canadian government contributed an additional US$950,000 to support PAHO’s COVID-19 efforts in six Caribbean countries. PAHO did not stipulate how the funds would be dispersed among the countries but that they would be used to support technical cooperation.

This includes the acquisition of essential personal protection equipment, laboratory, and medical equipment, as well as supplies to be used by health care workers and hospitals in the Bahamas, Belize, Guyana, Jamaica, Suriname and Trinidad and Tobago.

Inter-American Development Bank (IDB)

In August 2020, the IDB approved the reformulation of a loan to use the available resources up to US$19,513,464.

The loan “Skills for Current and Future Jobs in the Bahamas” was approved in 2018 for US$20 million and set out to increase relevant skills and employability in productive jobs; improve the effectiveness of the Public Employment Services; and enhance the capacity of the labour market’s intelligence systems.

According to the Bank, the country requested use of the funds to provide emergency response to the impact of the pandemic and to support businesses in maintaining formal employment levels through the provision of wage subsidies. It was reformulated to support formal employment retention in key economic sectors and the first part of this programmatic loan was approved and disbursed in 2020.

Additional documentation has been updated for two loan projects that specifically target the reduction morbidity and mortality caused by the COVID-19 and mitigation efforts. Currently at the implementation stage is a US$20 million loan that seeks to strengthen leadership response; expand health system capacity; finance access to vaccines; and bolster COVID-19 case management and essential care services. For this loan, the IDB allocated US$1,065,000 for project administration, evaluation, and auditing costs.

The project financing is broken down into four components (excerpted from IDB):

Response leadership at the country level (US$855,000)

This component will finance: a platform for epidemiological surveillance and public health (software and hardware) and technical support (public health and digital health experts) to streamline the response processes and strengthen the digital health information systems for real-time management and monitoring of the pandemic in the country; and the strengthening of the national logistic support system (software, hardware) to track procurement processes and use of medical supplies, pharmaceuticals, and therapeutics within the public health system.

Case detection and monitoring (US$7,040,000)

This component will support actions to expand the health system’s capacity for screening, case detection, contact tracing, reporting, and monitoring of COVID-19 cases, focusing especially on 54 health facilities that are the key points of care in the capital and the Family Islands.

Interruption of the chain of transmission (US$6,410,000)

This component will finance access to vaccines; design and implementation of a public communications campaign; update of care protocols and strengthening of points of entry.

Improvement of the capacity for service delivery (US$4,630,000)

This component will support the strengthening of the COVID-19 case management capacity and the continuity of essential care services during the emergency.

The second loan project is valued at US$40 million and is still in the preparation stage. The bank outlines its specific objections are to: integrate primary and secondary care services that DPH, PHA and NHIA deliver; improve access, coverage and quality of community, ambulatory, and hospital services through a person and community-centred model of care; and increase health services efficiency. This project has allocated US$2 million for program management, audit, and other costs.